Portfolio

Our investment portfolio includes a diverse range of assets across various sectors and regions. We have holdings in equities, bonds, real estate, and alternative investments to ensure a well-balanced and risk-adjusted portfolio. Our focus on both growth and income-generating assets aims to achieve long-term financial objectives while managing market volatility effectively. Regular monitoring and strategic rebalancing are key components of our investment approach to adapt to changing market conditions and optimize performance over time.

The Plan.

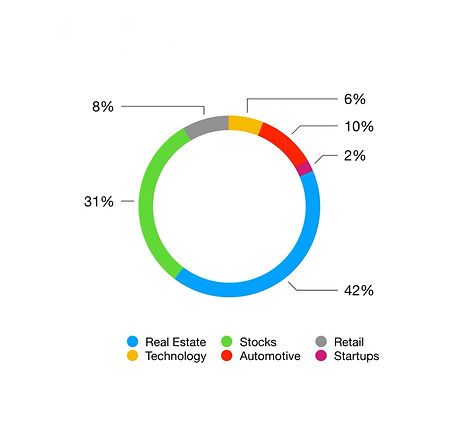

Our investment strategy moving forward focuses on maintaining the majority of our portfolio in real estate and stocks. Real estate has historically provided stable returns through rental income and property appreciation, while stocks offer the potential for long-term growth and dividends. By diversifying between these two asset classes, we aim to balance risk and reward effectively. Continually monitoring market conditions and adjusting our investments accordingly will be key to maximizing returns and achieving our financial goals. Our plan is to stay informed, stay diversified, and stay focused on the long-term success of our investment portfolio.

SATSAA HOLDING PORTFOLIO

2024-2025

Our investment portfolio is diversified across various sectors to mitigate risk and maximize returns. As of the current date, our allocation stands at 42% in Real Estate, 31% in Stocks, 8% in Retail, 6% in Technology, 10% in Automotive, and 2% in Startups. This strategic distribution allows us to capitalize on opportunities in different market segments while maintaining a balanced investment profile. We continue to monitor market trends and adjust our holdings accordingly to ensure long-term growth and stability.